The Capacity Market

The CM dictates the generation stack

Great Britain has a Capacity Market. These are annual auctions to award contracts that secure the supply of electricity generation for the next winter (T-1) or for four years' time (T-4). The Capacity Market drives what capacity is built on the system, so it is important in determining the evolving supply stack.

The GB Modo Forecast includes a forecast of Capacity Market pricing, volume, and de-rating factors. Forecast subscribers can download the numbers in our Scenario Databook.

For more information on the Capacity Market, check out the Energy Academy

For more information about the latest T-4 2024 Capacity Market results, see this recent research piece on the Modo platform or search for the 'Capacity Market' by hitting control+K.

The Capacity Market prices influence retirement and new-build decisions

The T-1 auction primarily indicates the cost of prolonging retirement for thermal assets; the T-4 auction mostly indicates the cost of new build generation assets.

E.g. if someone bids into the T-4 auction and is successful, their asset will need to come online 4 years later.

The Capacity Market does not impact the daily storage operation (or any other generator). Assets with a Capacity Market contract also participate in wholesale, balancing, and ancillary markets.

How Modo forecasts Capacity Market auction rounds

Capacity Market prices are updated as part of our Capacity Expansion Model. For the first iteration of the model we use forecasted values which are calculated as follows:

- Using the Consumer Transformation Future Energy Scenario (FES) from NESO, we form a base view of the upcoming capacity that will come online.

- We consider each technology's entrance cost, applying a "learning rate" (i.e., assuming that technologies get cheaper to build over time). We take technology cost numbers from the latest auction or other Modo research and assume a cost of capital.

- Assets supported by other state aid, such as a Contract for Difference, cannot be awarded a Capacity Market contract.

- Get the volume of capacity required by running our fundamentals model, using the annual minimum margin to assess how much capacity should be built to avoid loss of load.

- We use these to determine each unit's capacity and price point. The point at which forecasted demand meets supply on the stack sets the Capacity Market price. In GB, the price is often set by gas, which is cheaper than hydrogen, CCS, or long-duration storage but is more expensive than (most) renewables.

Our stated CM clearing prices are the maximum a plant gets paid - ie with no de-rating factors.

Within the Capacity Market, derating factors are applied to the capacity (MW) of each asset. Capacity Market revenues are calculated by multiplying the T-4 or T-1 clearing price by the asset derating factor.

Derating factors are technology-specific, designed to reflect the ability of each type of generation to help the system in a stress event. CCGTs have a 91% derating factor, whereas duration-limited technologies such as BESS carry lower derating factors.

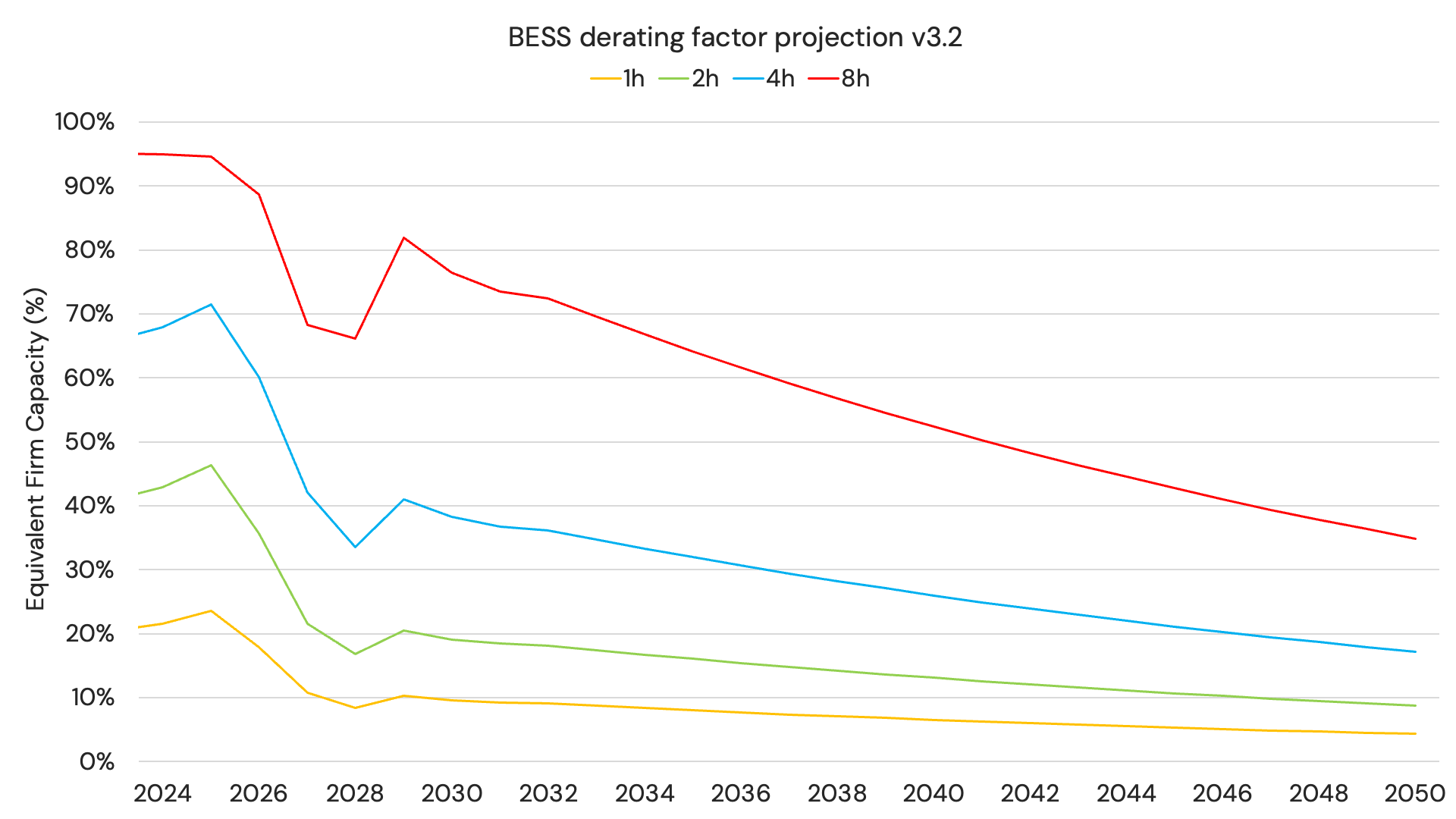

In recent years, BESS de-rating factors have been particularly low. In 2028, a 1-hour system will reach a record low derating factor of 8.4%. After 2028, NESO's new derating factor methodology for BESS will apply, boosting 1-hour systems to 10.3% in 2029 (see our piece for more details).

In the long term, NESO's modelling suggests that the distribution of possible stress events will shift towards less frequent, longer-lasting events as we transition to an electricity system dominated by intermittent generation. The longer a given event lasts, the less utility a battery of given duration can offer to help relieve system stress. Therefore, we expect BESS derating factors to gradually decline going forward.

Our calculation:

We convert Capacity Market revenues from £ / kW to £ / MW / year to use in our forecast.

(The T-4 or T-1 clearing price for that delivery year) x (the de-rating factor forecast) = £k / MW / year

Within our world view databook, we show Capacity Market derating factors by calendar year. The CM delivery year runs from October 1st - September 30th, so the percentages shown are weighted to the two years of CM years that the calendar year covers. For example, the calendar year 2028 has 9 months (Jan - Sep) of 2027/2028 and 3 months (Oct - Dec) of the derating factors for 2028/2029.

Capacity Market Reform will come, and Modo assumes it will have a carbon element

In July 2023, DESNZ published a report detailing alternative Capacity Market auction designs. The report detailed three potential designs, all shifting from a technology-neutral Capacity Market to one promoting low-carbon capacity buildout and better aligning with decarbonization goals.

One of the designs is a single auction with additional multipliers to increase revenues for low-carbon generators:

A single auction with multipliers: In which technologies with different characteristics

participate in a single auction and with a single clearing price, but in which technologies

with certain characteristics have a multiplier applied to the clearing price in the auction

to reflect their additional value in delivering a decarbonized (and/or flexible) electricity

system.

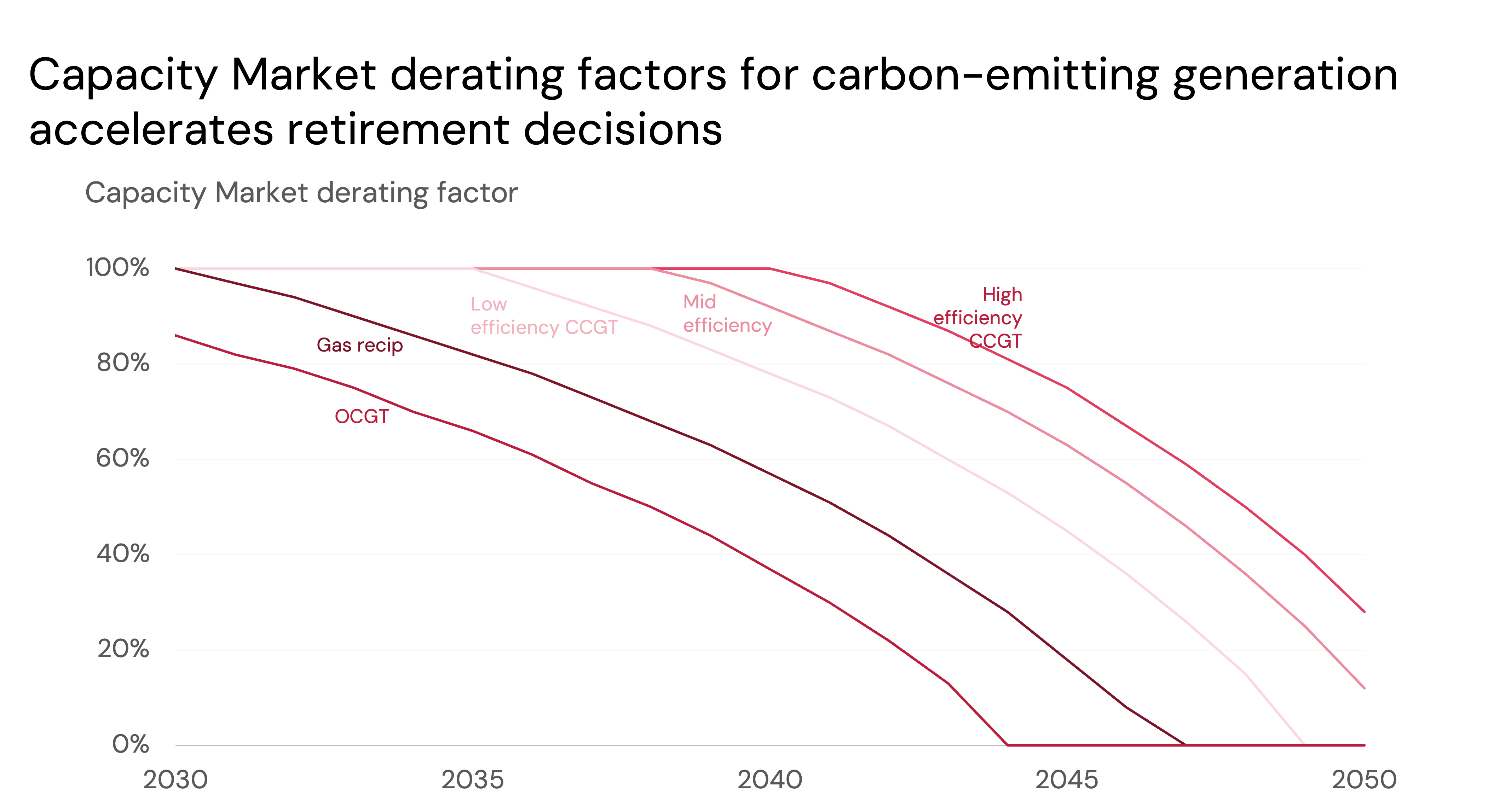

We assume an additional derating factor for carbon-emitting generators from 2030 onwards to reflect these possible reforms. This derating factor decreases with time and is first introduced for the lowest efficiency and highest carbon-emitting generators.

This approach introduces different capacity market prices for different technologies.

The capacity market price that we report is the highest price acquired by any technology for a given year.

Given its ability to deliver decarbonized and flexible power, we anticipate that this is the price that BESS will be paid.

Updated 4 months ago