Modelling thermal short run marginal costs

We describe the short-run marginal costs for each generation type here.

However, we modify some of these for thermal plants when we build our supply stacks. This considers different plant efficiencies within the 'Efficiency CCGT' fleet (for example) and also accounts for the varying operational costs over a day (or longer) for these thermal plants.

We use this pricing behaviour for dispatchable gas and biomass plants - so it covers CCGT, OCGTs and Biomass, including Drax.

Thermal plants don't always bid at their SRMC - start costs & ramping can alter their strategy

The operational costs of a thermal plant are variable over time. This is not just due to gas or carbon pricing—variations in cost include start costs, which vary if the plant is warm or cold, and its output (compared to the power plant's rated power). It has different efficiencies at different run points, and during ramping.

For example, a plant that needs to ramp up requires a higher price than the average short-run marginal cost, as it must factor in the start costs. Conversely, a plant that is already generating (for example, in the morning peak) might wish to stay online longer, into the evening peak, and run for a few hours at a loss during the middle of the day. This is often when solar is pushing power prices down. Despite running at a loss for those few hours, it avoids the cost of de-loading and then ramping up again - overall, it makes more. These plants might bid at a lower price during the middle of the day to stay within merit order. Or, they could be making revenue from other markets (like ancillaries) and therefore not need to recover all costs in wholesale markets.

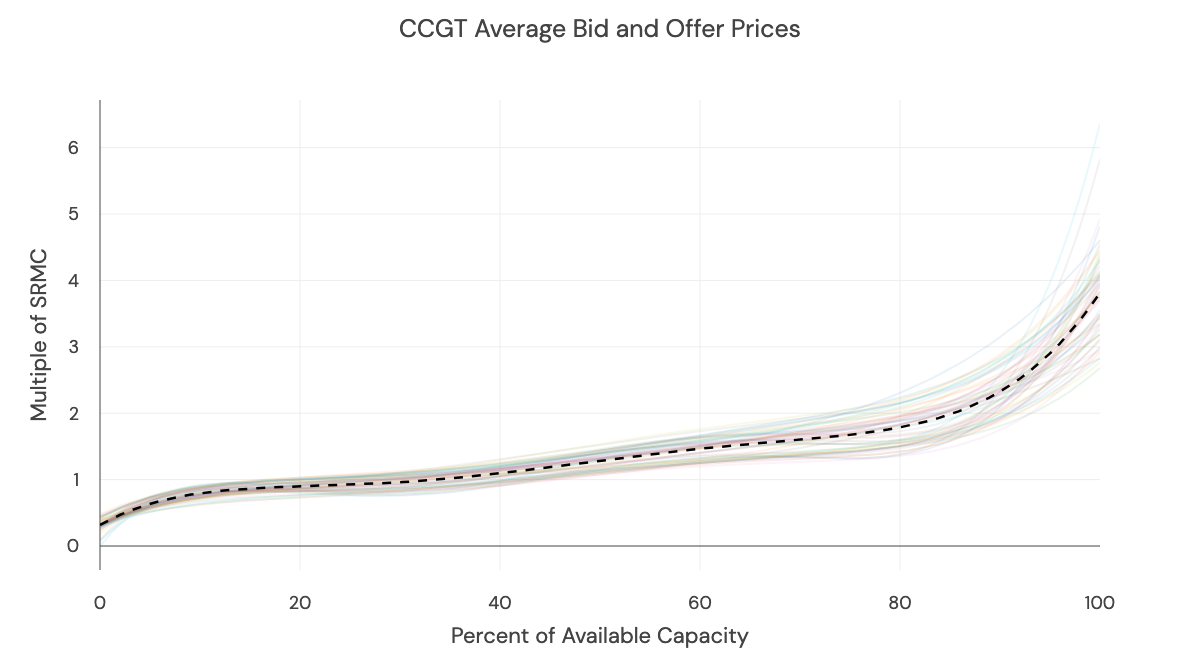

The graph below shows data from the Balancing Mechanism for all CCGTs over 2023. Each colored line shows an individual week. Taking the incremental volume of each bid-offer pair and expressing it as a percent of the short-run marginal cost of the day (using gas spot price and assuming mid-efficiency), we find that the cheapest 20% of volume of bids and offers are below the average daily short-run marginal cost. These are the most efficient units, running close to their most efficient point. On the flip side, the most expensive 20% of volume bid and offer significantly above the average short-run marginal cost - these are typically lower efficiency plants or plants factoring in start costs to their pricing.

To model variable thermal costs, we use bid-offer data from the Balancing Mechanism to scale average short-run marginal costs

We take the average SRMC for a specific generation type and vary it, based on several factors.

Variable efficiencies across the thermal fleet

We use historical Bid and Offer data (as above) to determine the price the available fleet capacity is bidding in at, compared to the fleet's average SRMC on that day (which is set by carbon and gas prices). This reflects different efficiencies within the fleet. We normalize these curves and apply them to the average short-run marginal cost, producing a variety of prices across the fleet.

An example supply stack for one half-hour for CCGTs is below.

We also carry out this process for gas recip engines, biomass, and gas OCGT plants. This results in a variety of prices across dispatchable generators:

CCGT ramping

CCGT ramping can be approximated using the rate of change of demand minus renewable generation (otherwise known as de-rated margin). As demand falls off, and renewables don't follow, on average the CCGT fleet ramps down. Some of the gas fleet prices itself lower to stay within merit order and avoid future ramping costs. This impacts the average SRMC during the middle of the day, and overnight.

Other markets

CCGTs can make money in other markets besides wholesale day-ahead. For example, they may be paid for providing grid inertia, voltage support, or frequency management via Mandatory Frequency Response, as well as close to real-time balancing in the Balancing Mechanism. This means they don't need to recover all costs in the day-ahead market, especially when renewable generation is high - since more inertia and balancing may be needed.

So, we vary the daily shape of SRMC to capture pricing behavior when just a few gas plants stay online, during periods of low net demand.

These trends are also explored in our recent Benchmarking article; which explains why we've seen so much negative pricing while CCGTs are running so far in 2024.

These changes give a variable thermal short run marginal cost which is evident in the example supply stacks in the next pages.

Updated 4 months ago