Scenario modelling (worldviews)

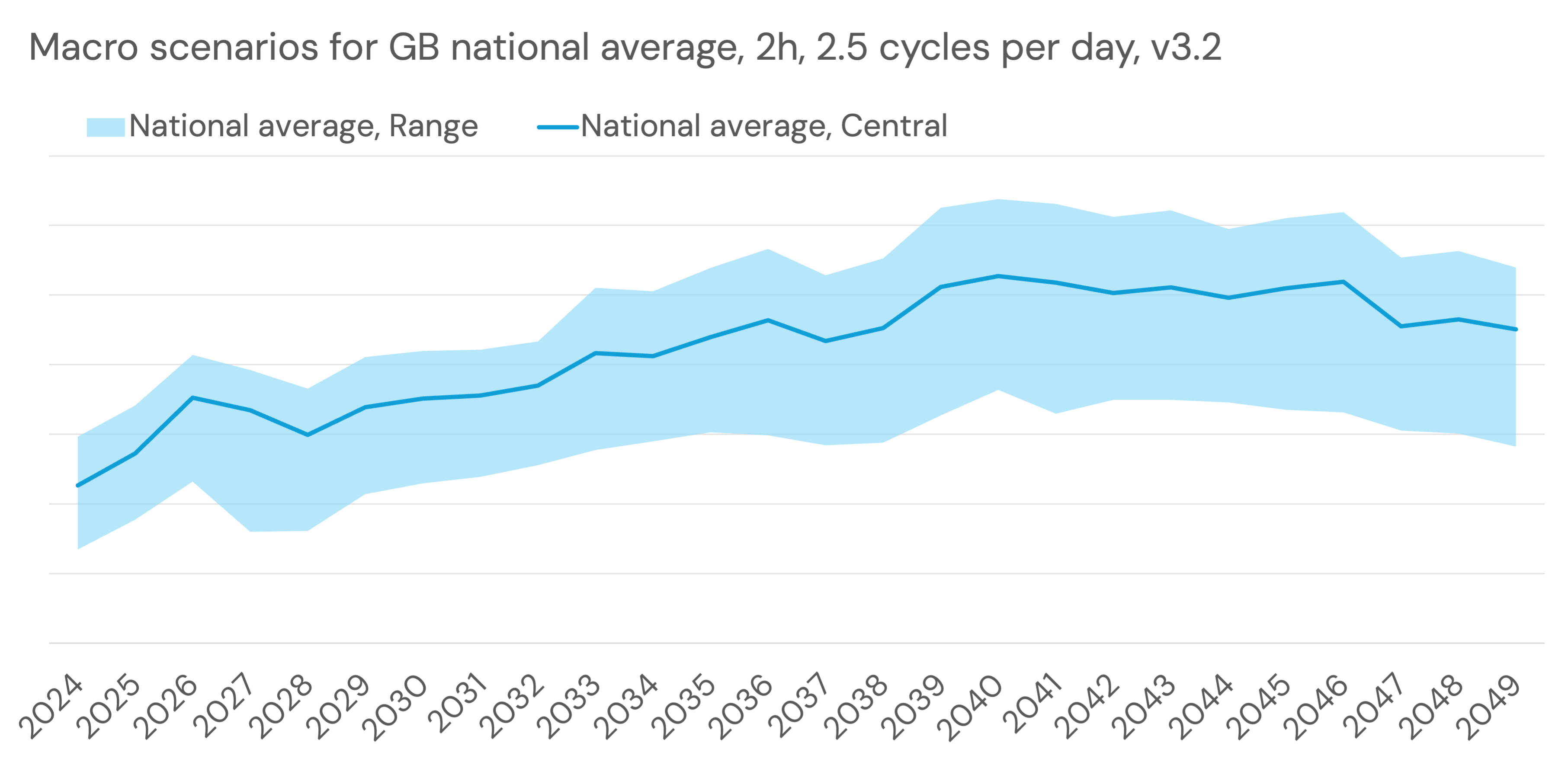

Modo forecasts a 'low' case and a 'high' case for different risk appetites.

The low case assumes more conservative fundamentals & battery dispatch

- Slow the retirement of unabated gas using more conservative carbon de-rating factors in the future capacity market.

- Apply a 15% reduction to gas and carbon pricing along the curve which reduces power prices and spreads.

- More, cheaper Demand Side Response, acting as a competitor to battery energy storage.

- Reduce battery dispatch rates in the Balancing Mechanism due to a slower roll out of software updates in the open balancing platform (see below)

- Reduce the revenue of optimised intraday actions by 20% to account for poorer capture of continuous intraday price opportunities.

- Assume the asset is performing less well, compared to the rest of the battery storage fleet: use the 25th percentile of the 1h or 2h Modo Benchmark for the calibration factor (as opposed to the median in the central case)

The high case assumes more optimistic battery dispatch

- Increase Balancing Mechanism dispatch by assuming that the competition from other BM units is reduced by half.

- Increase the revenue of optimised intraday actions by 20% to account for better capture of continuous intraday price opportunities.

- Assume the asset is performing well compared to the rest of the battery storage fleet: use the 75 percentile of the 1h or 2h Modo Benchmark for determining the calibration factors (as opposed to the median in the central case).

Updated 4 months ago