Day-ahead and frequency response revenues

Our battery dispatch tool creates a charge/discharge schedule from wholesale prices & handles ancillary services

The dispatch model uses linear programming to optimize the modeled battery

We take:

- Forecast day-ahead power prices

- Forecast Dynamic Frequency Response prices

- Forecast Balancing Reserve prices

- An indication of revenues available in the Balancing Mechanism

- Battery power, duration, efficiency

- Desired cycling

We then use a dispatch model to decide how much money a battery can make in wholesale day-ahead markets, Balancing Reserve and each of the Dynamic Frequency Response markets (Dynamic Containment, Moderation, and Regulation; high and low), respecting all the rules of each service.

Frequency Response market saturation is modeled see here, and we model prices after the changes to the clearing algorithms resulting from the Enduring Auction Capability.

Example dispatch profiles

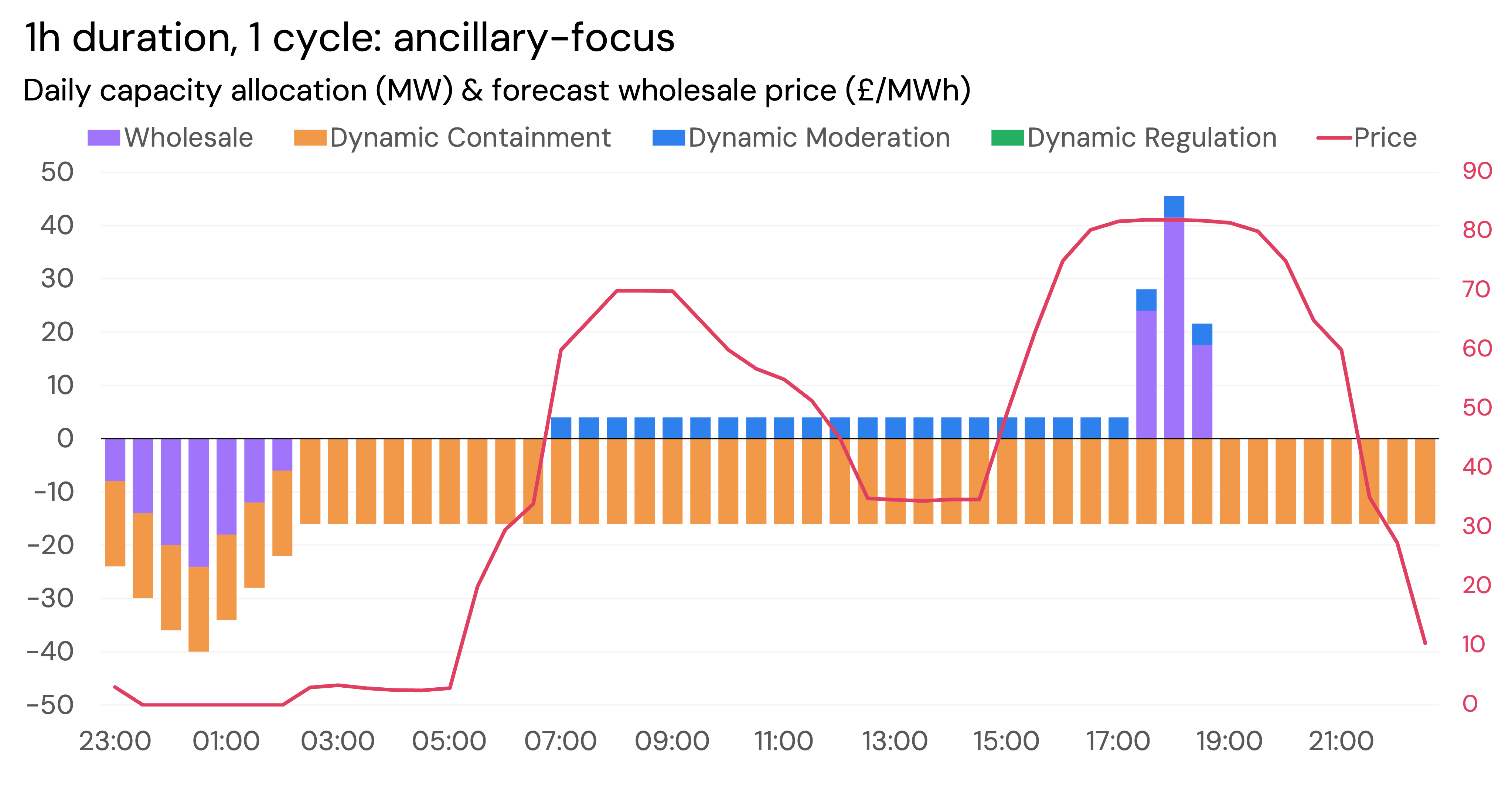

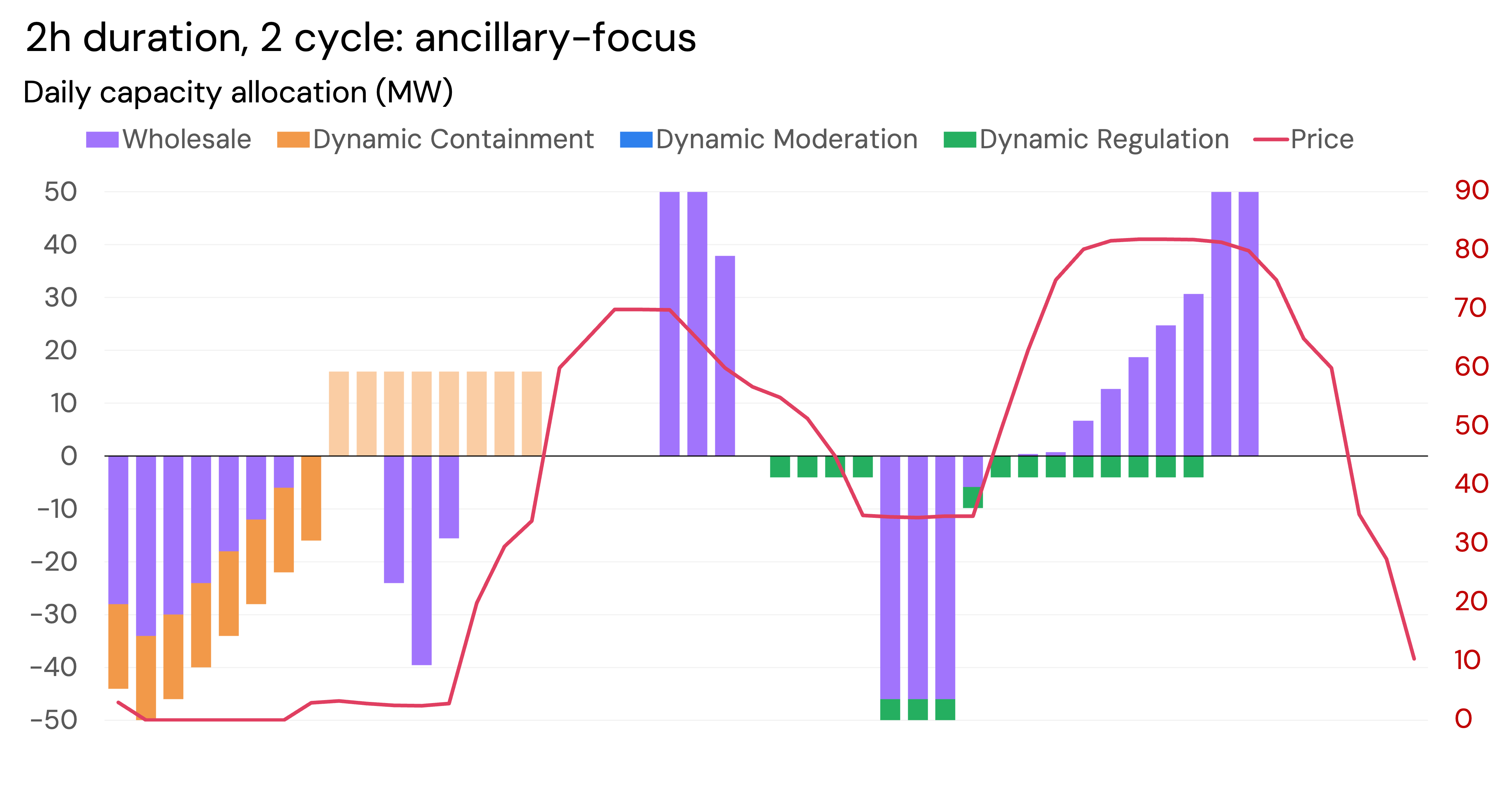

Below are two examples showing both a 1h battery cycling once per day, and a 2h battery cycling twice per day, being optimized across wholesale and frequency response markets.

Volumes in Dynamic Containment (high and low) are higher than in Dynamic Regulation and Moderation, as volume requirements and, therefore average battery participation in this market are higher.

We make various assumptions and respect the rules when deciding what the optimal schedule is

Assumptions are listed here.

But what does 'optimized' actually mean? How do we decide how much MW of a certain service a battery should participate in, or indeed, which service?

The optimization model:

- Works out the cost of providing each service - ie the cost of the throughput and the energy cost.

- Looks at the other opportunities available, ie the wholesale arbitrage opportunity, and in the Balancing Mechanism.

- Optimizes over a 1-day chunk of time at once.

- Ensures that any rules around each service are complied with - see assumptions above.

- Looks at many (many) different possibilities so it is able to work out the one that gets the maximum revenue across the available markets.

- Comes out with a contracted MW in each service (or a buy or sell order in the day-ahead market).

This is what we mean when we say 'it optimizes to get the MW in each service'. The optimization process essentially looks at a lot of different combinations and finds the one that delivers the most revenue while respecting the rules it is given (otherwise known as 'constraints').

Frequency Response Market Saturation limits battery revenues

- We restrict how much Dynamic Frequency Response and Balancing Reserve a battery can do, due to the increasing competition in these markets as the storage fleet grows. More on this here.

Updated 4 months ago