Solar co-located revenues

Optimizing the day-ahead revenues of a solar + battery storage co-located site

Alongside standalone battery revenues, our forecast includes revenues for co-located sites.

A co-located site has both a battery and another kind of load (generation, or demand) connected to the grid using the same connection.Check out the Modo Energy platform for more info:

https://modoenergy.com/research/co-location-battery-energy-storage-explained

How do we forecast co-located revenues?

We only consider batteries that are co-located with solar generation at the moment.

Let's firstly consider the solar asset

Solar generation can be:

- Exported directly to the grid. We calculate solar revenues due to PV generation exports using the half-hourly wholesale power price.

- Used to charge up the battery. Rather than directly selling solar generation to make money, the battery can be used to 'time shift' the solar generation - ie charge up from the solar and discharge at a later (more profitable) time.

- Wasted. If neither solar export to the grid or to the battery is optimal, solar is wasted. This typically occurs when power prices are negative.

Operation - so our optimisation - depends on whether the site is AC or DC coupled.

AC and DC coupled sites have a different set up: more info here.

If the site is AC-coupled, any solar generation exceeding the inverter power is 'clipped' - it is dumped as heat. This happens when the solar is oversized compared to the grid connection. While some PV generation is lost, the overall load factor of the site is higher.

If it is DC-coupled any solar generation exceeding the inverter power can still be used to charge up the battery, that otherwise would have been wasted.

On AC coupled sites, the battery looks more like a stand-alone site

The battery runs independently of the solar asset on AC coupled sites: it can be optimized and dispatched in exactly the same way as for a standalone battery, only the sum of solar exported power and battery exported power must not exceed the grid connection.

- This looks a bit like a variable export connection, which has an inverted solar profile on it - assuming the the solar always takes priority (which is often the case)

- We do allow the battery to charge from solar power that would otherwise be dumped - particularly when power prices are £0/MWh

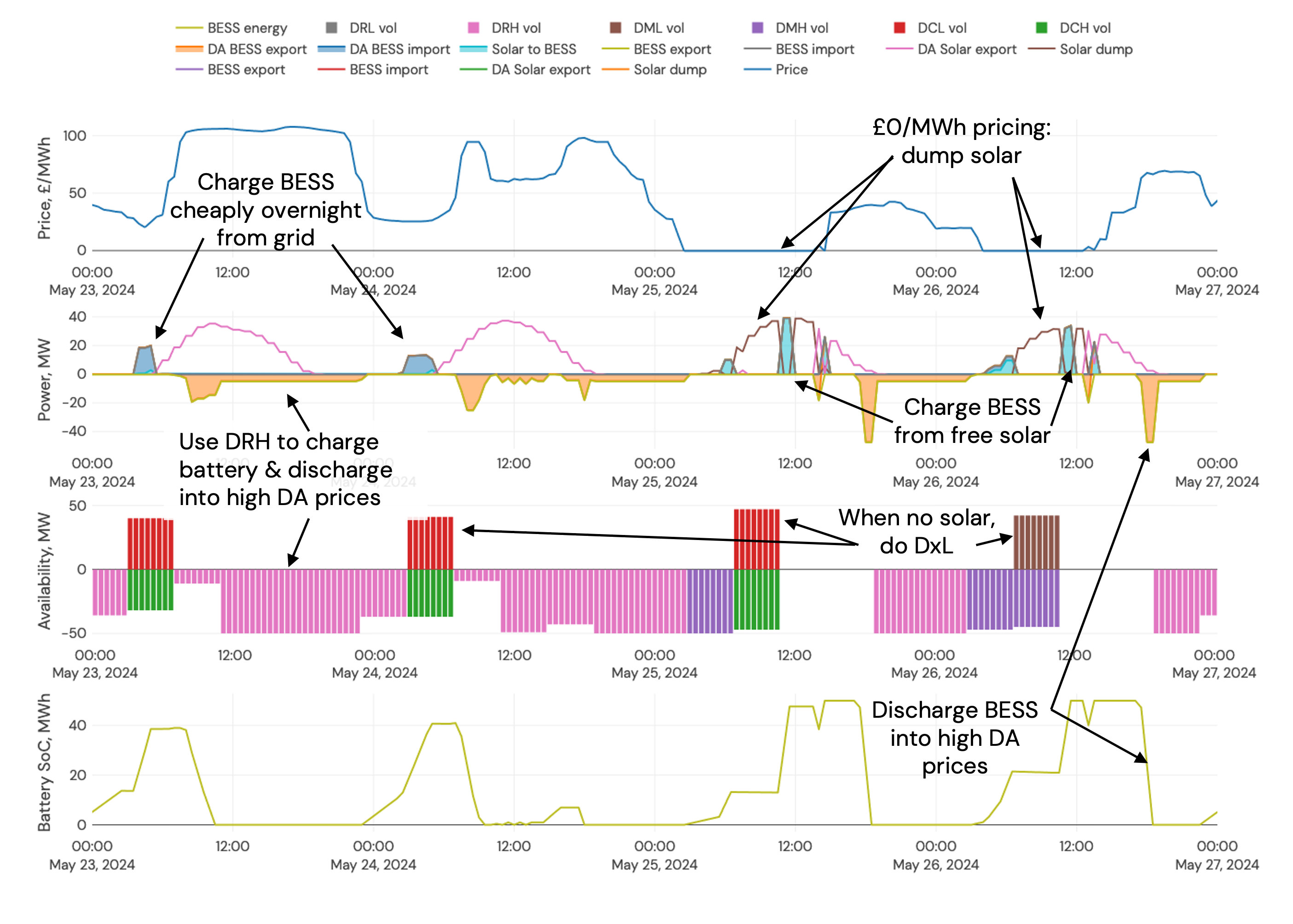

Example of merchant + ancillary optimisation for AC coupled co-located solar site

On DC-coupled sites, batteries typically do more merchant trading

The battery and solar share an inverter, and AC metering occurs at the shared connection. Sites can participate in frequency response services (theoretically—there are none in the market actually doing it) if they have sufficient sub-metering. Baseline declarations for state of charge management and operational and performance metering will need to be submitted for just the storage.

Example of DC coupled merchant optimisation, on a site where solar is oversized vs export connection with smaller import connection

We show the combination of solar and storage revenues in total revenue figures

The optimisation of the site is dependent on the wholesale power price in our forecast.

So, we do not differentiate between solar and battery revenues for co-located sites: as the operation of the two assets are intrinsically coupled, therefore, so are revenues.

Instead our forecast provides total revenues for both the solar and battery combined.

If you'd like to quantify the uplift from the battery on its own, check out the run library for the similar standalone asset.

Updated 4 months ago