Generation costs

Each generation sub-type has a cost of generating power, positive or negative!

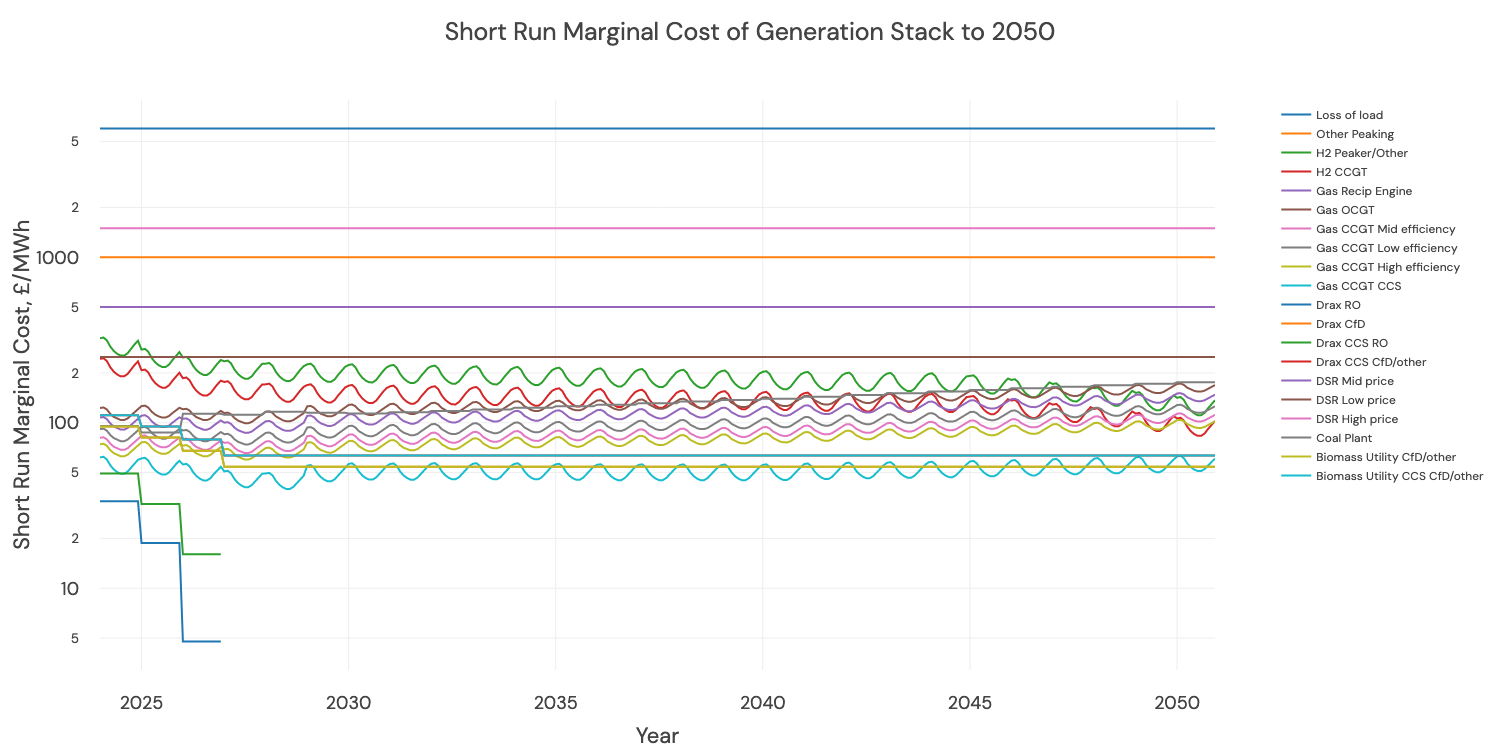

Fuel, subsidy, carbon, and 'must run' make up short-run marginal costs

Generators that require fuel (gas, coal, biomass, hydrogen) get a fuel short-run marginal cost (SRMC), considering each plant's efficiency. So, lower-efficiency gas CCGTs have a higher fuel SRMC than high-efficiency ones (because they use more fuel). Gas and hydrogen prices vary monthly, and biomass and coal vary annually.

Carbon costs are also accounted for, using the projection of carbon price from the FES and plant efficiency.

Subsidized generators may get paid for each MWh of energy they produce via a Renewable Obligation Certificate (ROC) or Contract for Difference (CfD) scheme. Inflation-adjusted ROC prices are applied, and generators on an early CfD round are set to £-100/MWh.

Other SRMC encapsulates other factors - eg; Nuclear must run; many generators embedded on the distribution network are not dispatchable and will normally run regardless of price; and Demand Side Response (DSR) requires a high price to run.

All of these SRMC are added together for each half-hour from 2023 to 2050 to give a cost per MWh of generation in each period.

Loss of load is priced at £6000/MWh.

Some SRMC are positive

Positive SRMC of note

- Various efficiency gas plants have varying SMRC over the year, as our gas price projection varies over the year. Those with the lowest efficiency sit higher on the stack, with hydrogen peakers in the dark green at the top of the variable lines.

- Biomass Utility sits below the cheapest unabated gas CCGT (flat lines as we assume biomass fuel is hedged at a flat price annually).

- Biomass CCS undercuts unabated gas CCGT once it is available (which is in 2030).

- The Gas CCS (bottom blue variable line) undercuts Biomass Utility CCS.

- DSR sits near the top of the stack, priced at £250, £500 and £1500/MWh.

Some SRMC are negative

Many of the wind and solar generation types sit at £0/MWh - so all their lines sit on top of one another.

Negative SRMC of note

We see Drax RO and Drax CSS RO go from positive SRMC to negative in the late 2020s - this is due to the fact they get a ROC (which is inflation-adjusted) and the biomass fuel cost reduces. Drax RO runs out of capacity in 2032.

- Nuclear has a SRMC of £-100/MWh - so it 'must run'.

- RO stops in 2027: we take into account the support start date on the site, or 2017, and add 20 years.

- ROCs are index-linked so those that keep going down are due to this inflation adjustment (linked to RPI).

Updated 4 months ago