The Capacity Market

The CM dictates the generation stack

Great Britain has a Capacity Market (CM). These are annual auctions to award contracts that secure supply for the next winter (T-1) or for four years' time (T-4). The T-1 auction indicates the cost of prolonging retirement for thermal assets; the T-4 auction indicates the cost of new build generation assets.

It should be noted that the Capacity Market dictates the generation stack.

The Capacity Market has no impact on the daily operation of storage (or any other generator). Assets that have a capacity market contract also participate in wholesale markets. Though the Electricity System Operator issues Capacity Market notices at times of system stress, this usually prompts the market to release more volume - and the market solves the shortfall. To date (June 2023), there has never been a Capacity Market event.

The Capacity Market really acts as a subsidy mechanism.

Batteries have dominated recent CM auction rounds

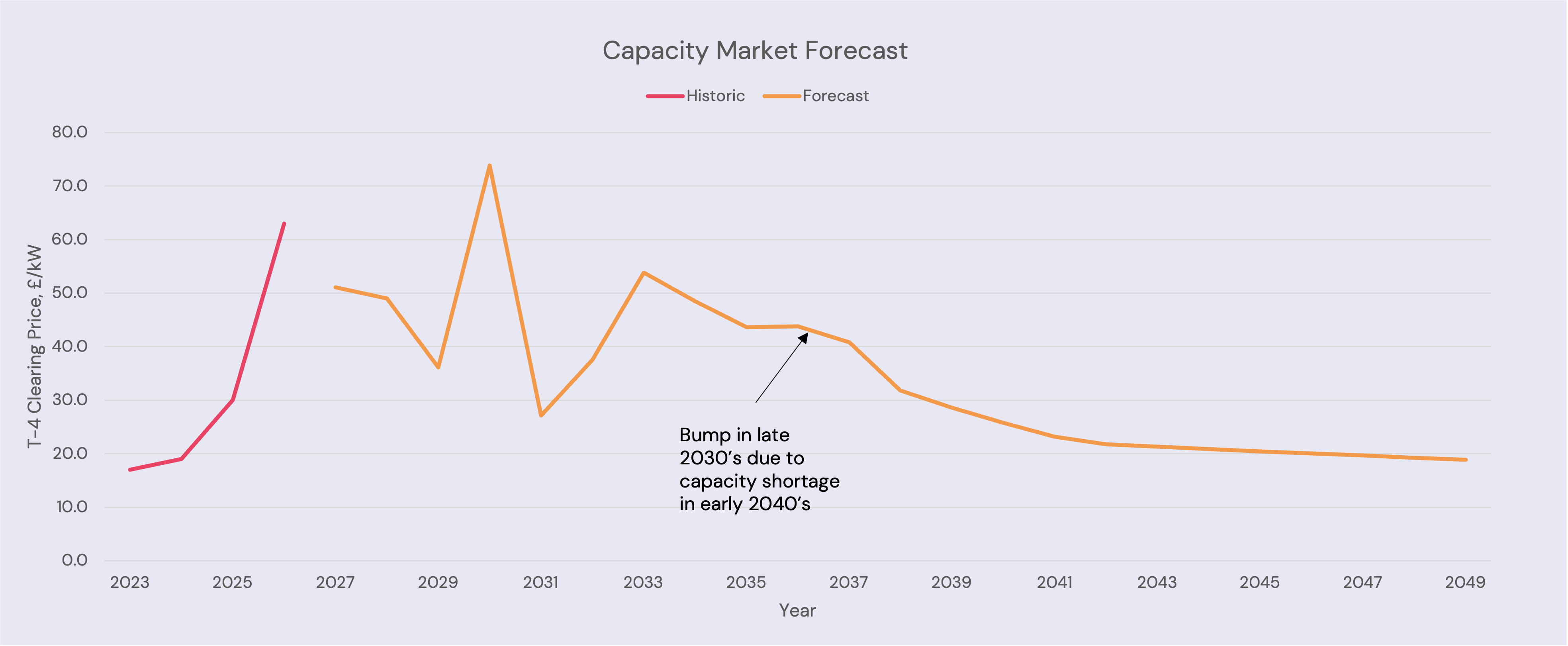

For this reason, we model prices - the Capacity Market offers another revenue stream and should be taken into account when forecasting revenues.

We look at what new capacity comes online, and we look at what the entrance cost of this technology is (with a learning rate applied, assuming technologies get cheaper over time). We take technology cost numbers from the latest auction or other Modo research, and assume a cost of debt.

The price is usually set by hydrogen, CCS or long-duration storage. We assume these plants are only eligible for a CM contract if they are not benefiting from any other state aid.

Storage is of limited duration; it faces de-rating factors. In Winter 2023/2024, a 1-hour storage system will get 18% of Capacity Market revenues vs a non-energy limited generator.

We also forecast de-rating factors for a 1, 1.5, 2 and 4 hour duration system.

Updated about 1 month ago