Model calibration (v3.1)

Taking our fundamentals model back to reality

TLDR; The Modo forecast is calibrated to real-world numbers using the Modo benchmark

To capture the realities of trading a battery in GB, we use historic data - both forecast and real-world, to apply a calibration to the forecast battery revenues going forward.

Modo Energy's GB Benchmarking Pro tracks each battery energy storage asset across Great Britain, and works out how much they earn, each half-hour of each day, in all the markets they operate in. At the start of 2024, over 100 sites and more than 3.5GW of battery energy storage are online in GB, and we follow each one of them (above 7MW) - having watched the fleet grow since 2020.

This gives us real-world data to calibrate our forward-looking numbers, taking our revenue forecast from a fundamentals-backed model to one cemented in reality.

Calibration that captures the realities of asset operation

There are a host of reasons why our fundamentals backed-model will miss the mark when we predict storage revenues:

- Battery availability is less than 100%

- Degradation from nameplate MWh capacity as the battery cycles

- Imperfect foresight of day-ahead wholesale prices

- High levels of participation in competitive frequency response services, meaning you're not guaranteed to win a contract

By comparing the output of our revenue forecast to reality, we can capture the impact of all these effects (and more) - making the revenue forecast more realistic.

We calibrate the forecast using accurate, real-world revenue numbers

We take revenues for Balancing Mechanism-registered battery assets in wholesale, frequency response, Balancing Reserve and Balancing Mechanism markets across 2024.

Balancing Mechanism registered assets have far greater data transparency than non-Balancing Mechanism registered units, as these units must declare charge and discharge actions to the Electricity System Operator. This makes the Modo estimated revenues for these assets our most accurate.

We look at the monthly revenues of each site and compare to our dispatch and Balancing Model model backtest in the same markets we model, to compare apples-to-apples.

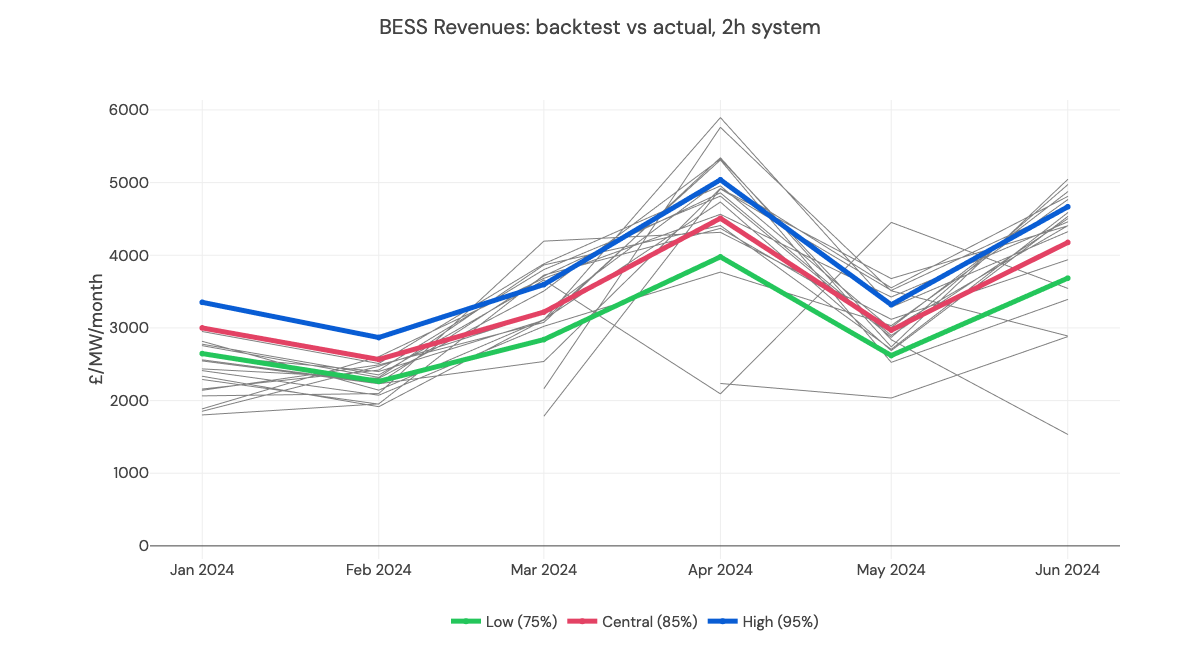

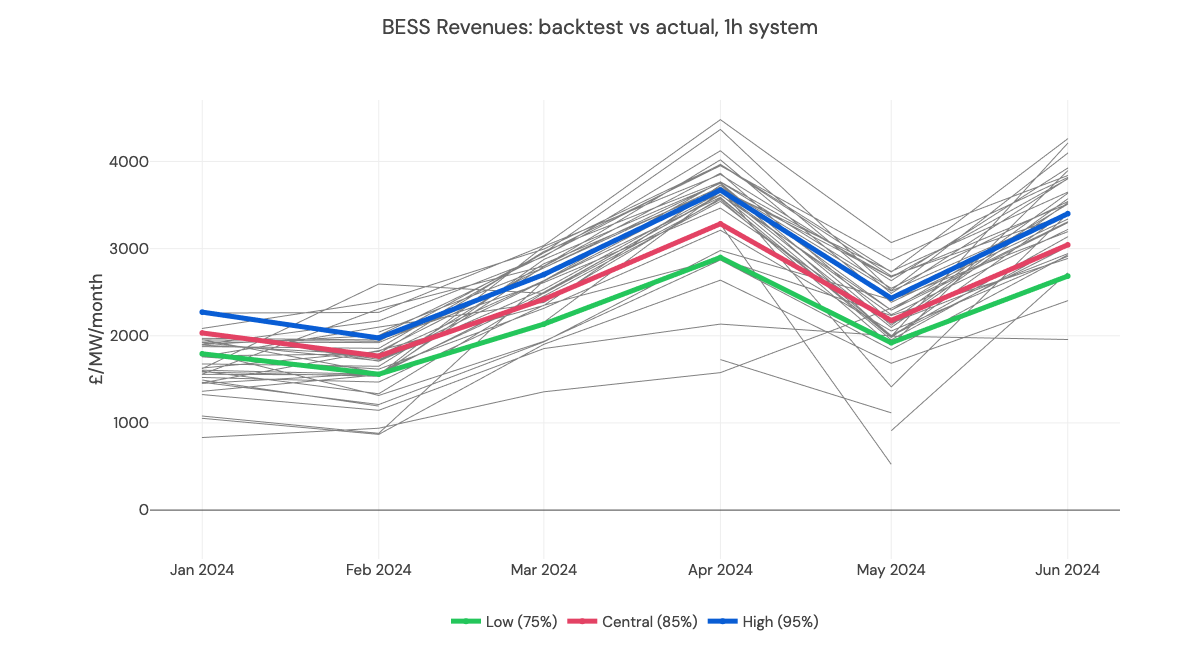

We compare the median fleet revenue to the revenue backtest

For 1-hour and 2-hour systems, the median revenue in Wholesale (day-ahead), Dynamic Frequency Response and Balancing Mechanism markets from January 2024 - June 2024 are 87% and 83.5% of the backtest revenues in the same markets. These are calculated using historical price data in our dispatch and Balancing Mechanism models.

This gives an average calibration of 85%, which we apply to the Wholesale (day-ahead), DFR, Balancing Reserve and Balancing Mechanism revenues in the Forecast.

Below, we show fleet revenues (each grey line is an asset) vs the calibrated revenue backtest.

Updated about 1 month ago