Building the capacity stack

How we decide the future capacity stack

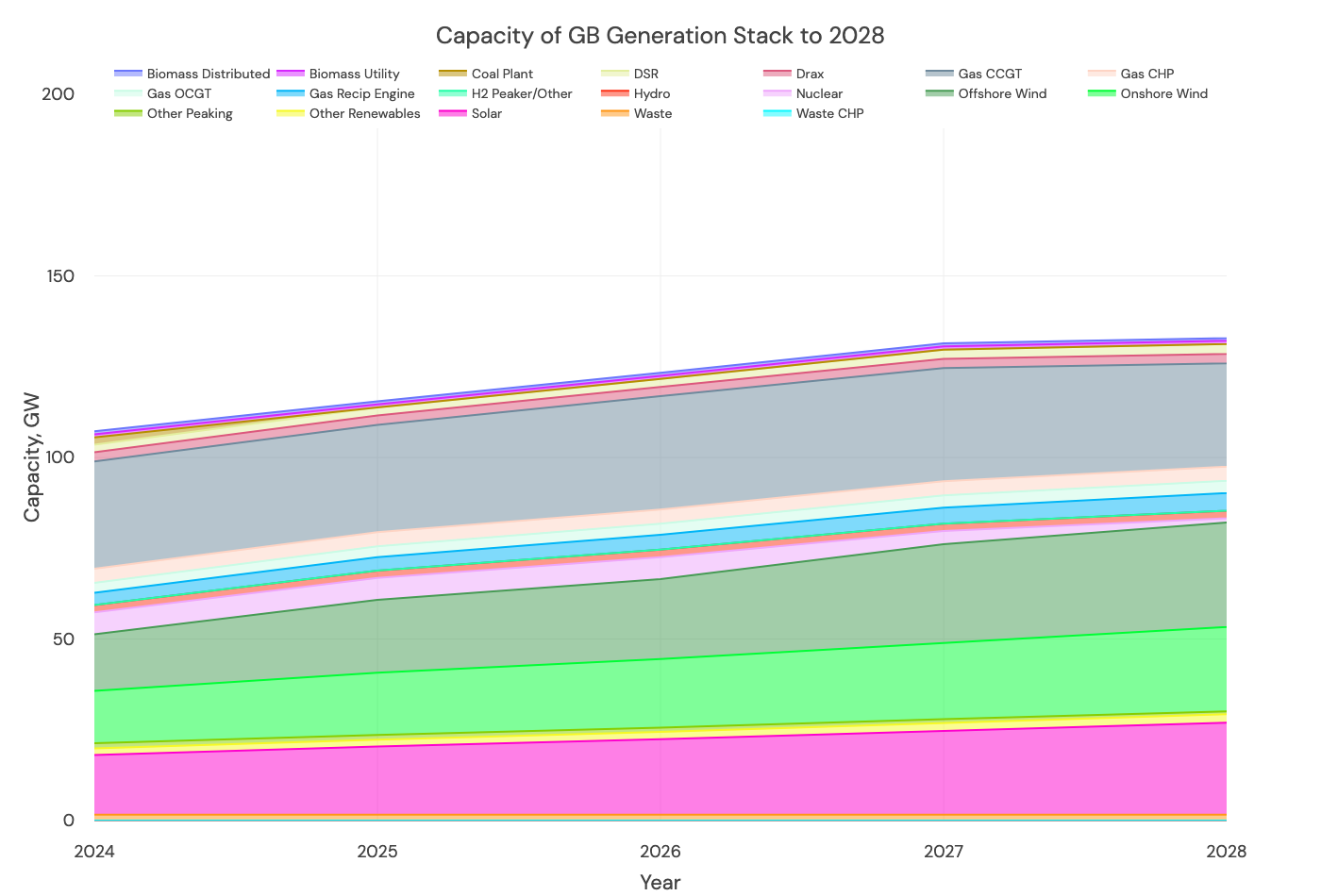

The capacity stack to 2028 is reasonably 'known'; power stations take years to plan for and build. Our capacity stack is therefore fixed to 2028.

After that, we have a capacity expansion model that allows the build-out of certain generation types to evolve. We generate revenues by using the predicted generator CapEx and OpEx costs and our modeled power prices across wholesale and capacity market. We examine the profitability of certain technology types (like gas) to model new build, retrofit, and retirement decisions and fix the build-out of others (like nuclear).

Inputs to the capacity mix are from well-known, public sources

We use the capacity market results, which run to 2028 (the T-4 announced in March 2024 awarded contracts from 2028).

For the first iteration of our capacity expansion model, we use the capacity stack from v2.4 of the Modo Forecast (with slight modifications to reflect the latest capacity market results). This is based on the Consumer Transformation scenario of the 2023 ESO Future Energy Scenarios, and altered to reflect renewable planning database, the TEC register, and previous capacity market results, as well as press releases (for example on the Hinkley Point C delay).

The Capacity Expansion Model is iterative

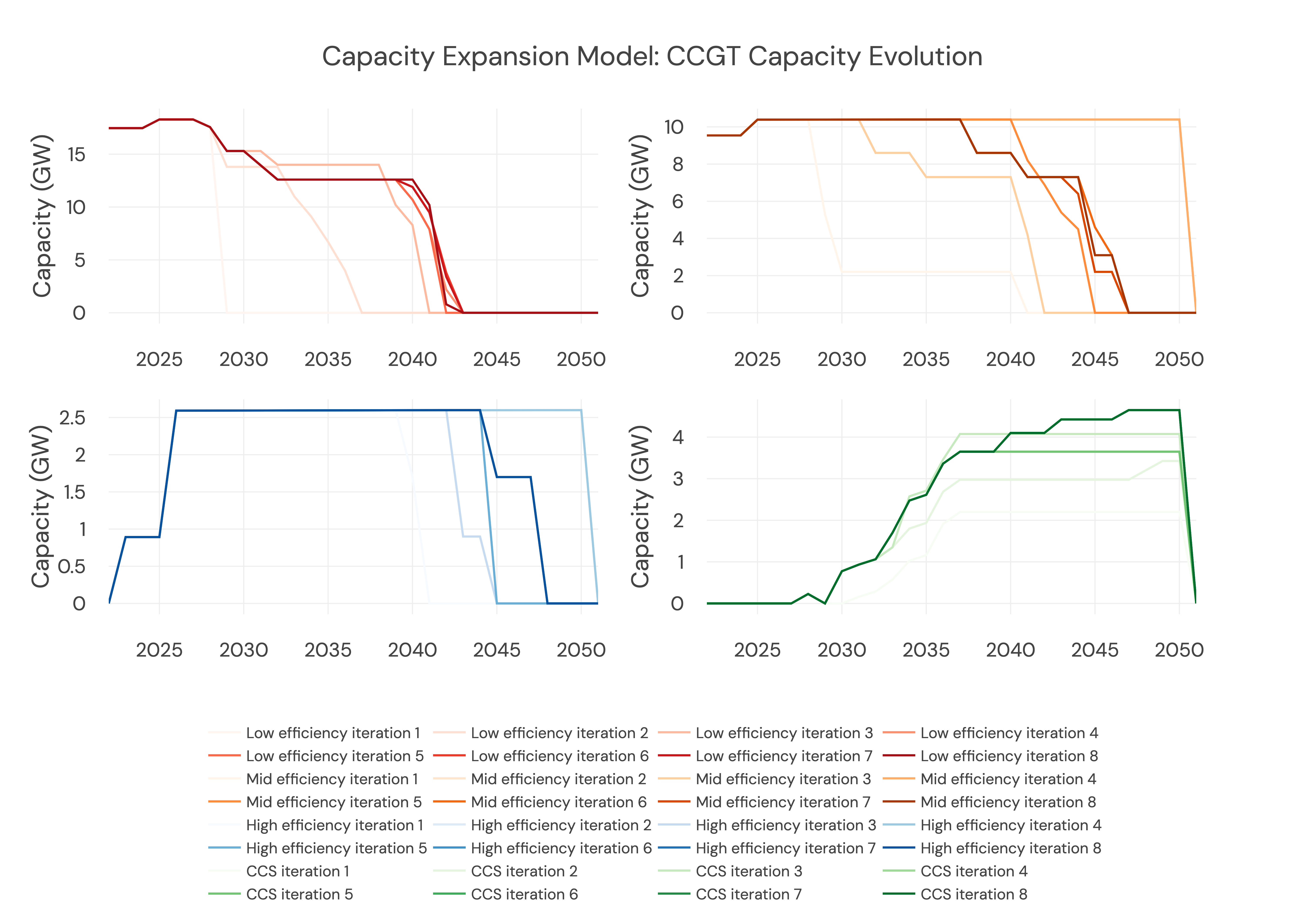

We determine the build-out post-2028 by looping through many economic scenarios:

- Run the fundamentals model with the initial capacity inputs described above

- Allow the build-out of OCGTs, gas reciprocating engines, batteries, and unabated and abated CCGTs to flex in response to economic signals

- Change capacity market prices to incentivize increased build-out and delay retirements in years where the minimum margin (difference between derated generation capacity and demand) is tight, and reduce build-out and early retirements in years where margins are high (and so prices are lower)

- Re-run the fundamentals model with the updated capacity stack and capacity market prices as inputs

- Repeat steps 1 to 4 until both the capacity stack and capacity market prices converge

Below is an example of how the capacity of mid-efficiency CCGTs evolves in one of the forecast development runs. Economics dictates that these power plants retire later than the 2023 Consumer Transformation of the FES suggests (given by the v2.4 dotted line, below).

Without significant carbon-based policy decisions to drive gas off the system sooner than 2046, there is still unabated mid-efficiency CCGTs long past when we are supposed to be running a net-zero power system in 2035.

Here, paler colors represent earlier iterations of the capacity expansion model; we see convergence after 10-15 iterations.

More info on this here.

Not all technologies are governed by pure economics

We only allow certain technology types to change their build-out depending on economics. The build-out of battery storage, peakers, OCGTs, and both abated and unabated CCGTs vary within our capacity buildout model.

Other generation types are fixed as we don't believe they follow typical economics which can be feasibly modeled to 2050:

- Nuclear is fixed - and typically has far longer project timelines.

- Hydrogen is subject to huge cost uncertainty, and policy will support any buildout. However, it is unlikely to be commercially viable within the forecast's time horizons.

- Wind and solar are fixed, and funded by a CfD scheme.

- Interconnectors are also subject to longer planning timelines, and we use the buildout as in the FES.

Updated 4 months ago